The company says it will be rolling out a one-stop shop for merchants, both online and local businesses, to manage payments from customers. Details are sparse but PayPal says that new features will include location-based offers, making payments accessible from any device and offering more payments flexibility to customers after they’ve checked out.

Category Archives: Banking and Finance

Tcho Tcho’s Digital Mobile Wallets Are Boosting Haiti’s Economy

Tcho Tcho’s Digital Mobile Wallets Are Boosting Haiti’s Economy | Fast Company.

There are glimmers of hope in Haiti’s rise from the rubble: Technology is playing a prominent role in the country’s recovery, especially in rebuilding Haiti’s ravaged economy and financial infrastructure–more than a third of Haiti’s banks were destroyed in the earthquake, leaving millions without access to money. (Though, even before the quake, fewer than 10% of Haitians had ever used a traditional bank.) But that’s changing, thanks to mobile wallet technology.

Google, ISIS Plotting The Downfall Of The Magnetic-Strip Credit Card

Two very big developments are about to happen in the NFC space, and together they might eliminate credit cards as we know them.

Google has been courting the idea of NFC technology for a while, and it now seems poised to launch a potential game-changer (as Google is wont to do). The Wall Street Journal reported that an announcement from Google on Thursday will reveal its new NFC mobile-payment tech. The program will “launch first in New York, San Francisco, and potentially other locations, followed by a broader rollout,” according to insiders who’ve spoken to the WSJ, with retail partners including “Macy’s Inc., American Eagle Outfitters Inc. and the Subway fast-food chain.” Stores taking part will have “upgraded terminals at the point of sale that can read the mobile devices and provide special offers.”

(Source: http://www.fastcompany.com/1755262/google-isis-plotting-downfall-of-the-magnetic-strip-credit-card)

(More info: http://thenextweb.com/google/2011/05/26/google-releases-wallet-and-offers-for-tap-pay-and-save-via-mobile/)

Spenz Wants To Help You

Sticking to a budget can be a challenge no matter how big or small your income is. While Mint.com gives you access into where your money is going, it doesn’t incentivize or motivate you to stick to a budget. Enter Spenz, a startup launching at TechCrunch Disrupt today, is launching a proactive way for a younger generation to track where they spend all of their money and provides incentives and rewards for users to budget.

MasterCard’s ‘You Play, We Give’.

GamesThatGive is one company helping brands take advantage of the social gaming boom via Facebook.

GTG makes custom-branded Facebook games with charitable twist. For example, its You Play, We Give campaign for MasterCard donates as much as 10 cents to Junior Achievement Hudson Valley for every minute a person plays the game, which has more than 30,000 Likes and gets more than 80% of visits from returning visitors. On average, gamers spend 45 minutes on the game page each visit.

(Excerpt: http://mashable.com/2011/05/03/social-gaming-marketing/)

The big money test

The BBC Lab UK’s Big Money Test explores the link between money behavior and personality. Its aim is to test the theory that how we manage our emotions under stress affects how we manage our money. Maybe what’s most interesting, is its finding that a person’s education has little bearing on their ability to make sound financial decisions.

The test found that people generally fit into one of five archetypes:

misers fear becoming penniless and have trouble enjoying the benefits of their money

spenders shop in an often uncontrolled manner, particularly when feeling low – and get a short-lived high, often followed by guilt

tycoons see money as a route to power and approval, and believe wealth will make them happy

bargain hunters feel superior when they get discounts, and feel angry if expected to pay full price

gamblers feel exhilarated when taking chances, and find it hard to stop – even when losing – as a win brings a sense of power.

(Excerpt from http://www.psfk.com/2011/04/the-emotional-impact-of-money.html)

You can only do the test if you have a BBC login, but the link is here Big Money Test

Venmo: it’s like your phone and your wallet had a beautiful baby

Venmo is a SMS-based secure payment app for iPhone and Android.

The basics:

- Links to a credit card and bank account.

- Allows users to charge, pay and trust other users (via SMS).

- It’s free and there are no transaction fees.

- It’s only in the US for now and it’s still only available for download via an invite.

Paypal Mobile vs. Venmo

There are two major points of differences. The first is that Venmo allows you to ‘trust’ people. When you ‘trust’ someone you no longer have to confirm charges from them. For example, if you ‘trust’ your friend John, and he charges you, the funds will be immediately deducted from your account and deposited into his. You will still be notified immediately via email and SMS, and have the option to reverse the charge. The second point of difference is that Paypal charges transaction fees and Venmo does not.

BankWest launches new site

BankWest re-launched their site on Thursday March 17, 2011.

Major changes include full screen brand images across the home and category landing pages, a major focus on search, product save and page sharing functionality. In a move away from the standard top bar navigation approach used across major banking sites in Australia (CommBank, ANZ, Westpac and NAB), BankWest have located their main navigation bar down the left-hand side of the screen, expanding it vertically for 2nd level links and right (into the body of the page) for 3rd level links.

What we like:

– The playful design approach in line with ‘happy banking’ branding.

– The focus on search (the idea, not the implementation).

– The product save functionality.

– The simple, subtle share functionality.

What we don’t like:

– That the site is difficult to navigate:

o The search is not intuitive.

o The site link copy is too often misleading or overly generic.

(Particularly on the 2nd and 3rd level pages of the site)

o The user experience flow often results in users bypassing the overview / comparison pages of the site and arriving at product detail pages with no top level context.

o Product detail pages are user journey ‘dead ends’ in too many cases, with no clear next steps back up to overview / product comparison pages.

Check out the site here http://www.bankwest.com.au/personal

We wrote a full analysis on this so if you want more details ask Abby

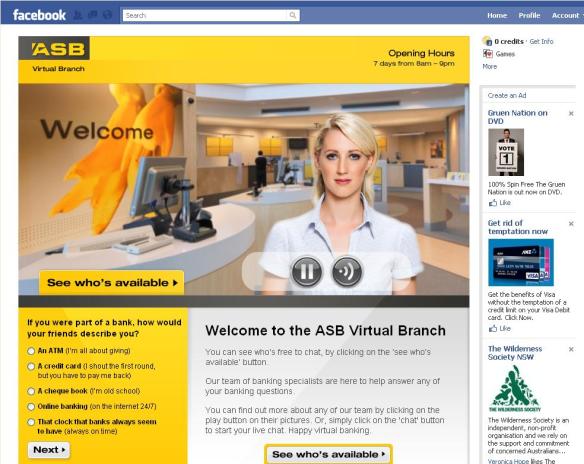

NZ Virtual Bank Branch on Facebook

Auckland Savings Bank (ASB), part owned by the Commonwealth Bank of Australia, has launched its Facebook customer service application, Virtual Branch.

The bank will offer real time customer service assistance over the social network site.

ASB will also break with Facebook culture, assuring customers that “live chats will not be posted on your wall”.

The service hooks up customers with the bank’s specialists, ASB claims on its Facebook launch page, and promises service levels equivalent to its branches.

The Virtual Branch is available seven days a week between 8 am and 9pm, with ASB’s FastNet Classic service the fall back option after hours.

(Excerpt from http://www.itnews.com.au/News/231992,cbas-nz-bank-facebooks-customer-service.aspx)

Big banks cop flak on twitter

| (Excerpt from http://www.theadviser.com.au/breaking-news/4249-big-banks-cop-flak-on-twitter)Tuesday, 14 September 2010 |

|

A study of five months’ worth of tweets about Australia’s big four banks has uncovered exactly what consumers think of the big four. The study by Christine Walker of Alliance Strategic Research found that consumers biggest gripes centered on the level of service they receive from their major. Of the 5,283 tweets analysed, 791 were about service – and 47 per cent of those were negative. Ms Walker told The Adviser that while no bank received more negative comments than the rest, ANZ was the most talked about of the big four banks, followed closely by Westpac. “NAB seems to stir the least amount of interest, as only 9 per cent of all the tweets we analysed were about National Australia Bank,” Ms Walker said. “Roughly 45 per cent of all tweets to each bank were negative, while 25 per cent were positive and the rest neutral.” Interestingly, Ms Walker said the bank that made its rate announcement first copped the most amount of flak. |